Are you overlooking the climate risks associated with your next real estate transaction?

Climate due diligence: A non-negotiable in real estate investments

The global trend towards stringent environmental regulations, coupled with clear evidence that sustainable properties yield higher returns and lower operating costs, makes one thing abundantly clear: Overlooking the climate risk of a property could lead to significant financial setbacks and missed opportunities.

However, gathering relevant ESG data for properties you don’t own and are considering acquiring or underwriting can be daunting. The information might not be readily available, current, or contextualized with necessary benchmarks for meaningful analysis.

Additionally, relying on external consultants to conduct climate due diligence can be costly and time-consuming, delaying critical transactions.

Fill out the form to for a 1:1 walkthrough!

Measurabl's Climate Due Diligence Scan

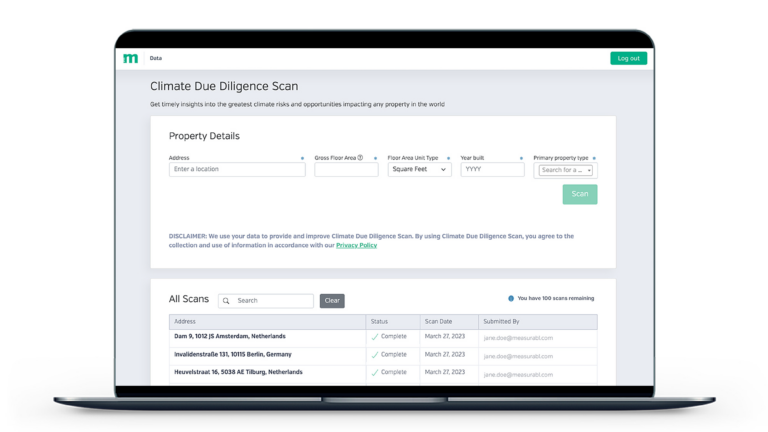

Mit der Measurabl’s Climate Due Diligence Scan (CDDS), you can run a climate due diligence report for a property in just minutes. CDDS provides reliable property-level estimates derived from Measurabl’s highly accurate machine-learning model, powered by a database of more than 17 billion square feet (1.5 billion square meters) of real estate worldwide, and trusted physical climate risk data from S&P Global Sustainable1.

CDDS offers visibility into the data points representing the greatest environmental risks and opportunities facing real estate properties for virtually any property in the world.

Granular, Impactful, On-Demand Data

Experience the Unparalleled Advantage of Climate Due Diligence Scan

Climate Due Diligence Scan provides material insights on any property you are evaluating. Get to the heart of what you need to make an informed decision with a standardized, on-demand report.

Evaluate climate risk for your next property investment in minutes

Provide just four property attributes—address, type, floor area, and year built—and get an instant view into its climate risks and opportunities. Discover how environmental factors play a crucial role in your acquisition strategy.

Before investing in a property, get a comprehensive understanding of its environmental risks and opportunities.

Climate Due Diligence Scan, designed for pre-acquisition assessment and loan underwriting, provides detailed insights, including:

- Energy consumption estimates

- Carbon emission estimates

- Physical climate risk scores powered by S & P Global

- Green-Building-Zertifizierungen

- Örtlichen Vorschriften

Benchmark and Evaluate with Precision

Access not only the current environmental performance of a property but also compare it against historical data. Assess how the property stands in comparison to global, national, and state environmental benchmarks.

Are you ready to get serious about climate risks?

Climate risks are financial risks—Measurabl’s CDDS gives you a comprehensive view of the environmental factors that affect your potential investments. We are ready to partner with you to optimize your organization’s due diligence process so you can better predict how your investments will perform in an uncertain future.